Acceptance Auto Insurance Review: Insurance for Imperfect Drivers

Acceptance Insurance claims to offer the lowest possible rates for car insurance, and this may be the case for high-risk drivers who need non-standard coverage such as SR-22 or FR-44 insurance. Our Acceptance Auto Insurance review finds that the company offers car insurance for as low as $20 per month.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Licensed Insurance Agent

UPDATED: Jan 5, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider. Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Jan 5, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider. Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Acceptance Insurance is rapidly growing after acquiring Titan Insurance in 2015

- Acceptance is a non-standard insurer, specializing in high-risk auto insurance

- Acceptance auto insurance quotes start from $20 per month

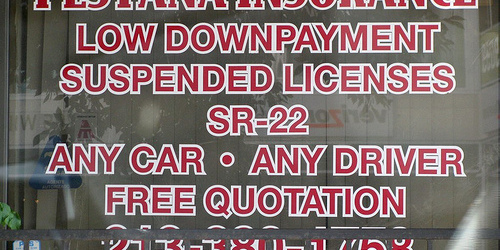

You may have seen television ads or billboards lately for “Acceptance Insurance,” which as the name implies, will probably accept you as a customer if you just give them the chance. They may not have the cheapest insurance rates or even the best coverage, but they are the best choice for many high-risk drivers.

Their flagship product is Acceptance auto insurance, though they also offer roadside assistance and some other types of insurance too.

I’ve seen billboards along the freeway here in Southern California, with ads saying something like get car insurance for as low as X per month. I forget the exact number, but it was something low, like $20, which you can pay with a credit card.

Anyway, let’s dig in and find out more about this fairly large, publicly-traded insurer to see if they could be a good fit for you. At last glance, their stock is worth about $68 million, which makes it a small fry in the industry.

Where does Acceptance Insurance do business?

Acceptance Insurance (parent company First Acceptance Corporation) is based out of Nashville, Tennessee, but does business in a variety of states, including the following:

- Alabama

- Arizona

- California

- Florida

- Georgia

- Illinois

- Indiana

- Mississippi

- Missouri

- Nevada

- New Mexico

- Ohio

- Pennsylvania

- South Carolina

- Tennessee

- Texas

- Virginia

They also offer personal auto insurance in California now. It’s a relatively recent move. So you’ll likely see California listed on their site and coverage lists soon.

Their business profile notes that they write personal automobile insurance policies in 17 states, but issue policies as a licensed insurer in 13 of those 17 states (those seen above). Additionally, they are licensed as an insurer in a total of 25 states.

Acceptance markets its insurance under a number of different brands, including Acceptance Insurance, Yale Insurance, and Insurance Plus, and has more than 350 retail locations nationwide. So hard-working people across the country can find an agent near them to discuss coverage options from liability only to comprehensive to non-owner insurance.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Does Acceptance Insurance offer the lowest possible rates?

We know there are seemingly countless auto insurance companies out there. So why choose Acceptance?

Well, first off they claim to be “different than other companies, and “proud of it,” though they don’t really get into the why.

However, Acceptance does say they offer the “lowest possible rates,” handle insurance claims quickly, and provide great service. Nothing earth shattering here. Based on estimates, they don’t necessarily offer the lowest rates for drivers with a clean driving record. They do offer affordable coverage for drivers other companies are unlikely to insure, though.

Perhaps something that truly differentiates them is the fact that they also have hundreds of physical locations, unlike many insurers that operate call centers you can’t walk into.

This allows customers to get in touch with someone face-to-face if they feel the need. This can be especially helpful while dealing with an insurance claim, because anyone that has ever dealt with a claim knows it can be a huge pain in the you know what.

What makes Acceptance a non-standard insurer?

All that fluff aside, Acceptance is a non-standard insurer, otherwise known as “high risk”, offering SR-22 or FR-44 car insurance It’s basically car insurance for those who don’t fit the traditional mold for one reason or another, whether it’s previous accidents or points or a combination of both. They offer proof of financial responsibility for those who need it and a smooth insurance process overall. They also have flexible payment options to make.

Sometimes, teens and elderly drivers fall under this distinction as well. In any case, Acceptance offers a number of types of auto insurance that others may not, including:

- High-Risk Auto Insurance

- SR 22 Auto Insurance

- Non Owner Auto Insurance

- Liability Auto Insurance

- Teenager Auto Insurance

- Bad Credit Auto Insurance

- Senior Auto Insurance

- Non-Standard Auto Insurance

Read More: Car Insurance Liability Limits

As you can see, there are some unique offerings you might not find with the big boys simply because those companies are more interested in insuring drivers who will rarely (if ever) get into an accident or slip up otherwise.

Speaking of risk, A.M. Best has given them a Financial Strength Rating (FSR) of C++ (Marginal), which compares to A-ratings for the big companies like Allstate and State Farm.

Aside from auto insurance, Acceptance also offers a variety of other policy types such as renters insurance, motorcycle insurance, roadside assistance, hospital benefits, MedPay insurance, and Ohio Bond policies.

However, they don’t offer health insurance, home insurance, or life insurance, at least not at the moment.

Read more: Allstate Auto Insurance Discounts

Acceptance Has Employee-Agents

If you call Acceptance, chances are you’ll speak with an “employee-agent,” which means the staff at Acceptance is composed of insurance agents.

And there’s a good chance you’ll be sold a non-standard personal automobile insurance product underwritten by Acceptance because that appears to be their main product.

In many of the states Acceptance does business in, there’s also a decent likelihood you’ll be pitched a complementary (not free!) renters insurance policy to go along with your auto insurance.

Offering this additional insurance provides them with a way to squeeze a little more profit, whether you need it (or want it).

In the states of Illinois and Texas, select retail locations sell insurance products that are serviced and underwritten by other third-party insurance carriers, not Acceptance.

And in four other states (California, Arizona, New Mexico and Nevada) that were newly-acquired, the insurance policies might be underwritten by other third-party insurance carriers.

Put another way, in many of these states you’ll actually receive a policy from a company other than Acceptance Insurance even though they’ll be the ones selling it to you for a commission.

By the way, if you’re an independent insurance agent you can sign on with Acceptance Insurance to sell their products.

Read more:

- Car Insurance Policy Terms: 6-Month vs. 12-Month

- Auto Insurance Checklist: What to Ask Your Agent

- Commercial Auto vs. Personal Auto vs. Business Auto

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Acceptance Might Be a Good Choice for Imperfect Drivers

Overall, Acceptance Insurance seems to be a growing brand for the non-standard market, delivered in a neat package with a logo that reminds me of Esurance Insurance.

It seems to be working against the typical “Crazy Sal” brand of low-cost insurers, thus making bad drivers feel better about obtaining car insurance.

You can also get free Accceptance insurance quotes online and do the entire process over the phone, instead of having to speak to another human being, something Millennials are increasingly against doing.

Acceptance Insurance seems to be a rapidly growing brand, especially after acquiring Titan Insurance in mid-2015. Thanks to that merger they picked up 83 new retail locations.

In the meantime, as mentioned, many of the insurance products sold in these states will come from unrelated car insurance companies.

To sum it up, if you’ve had trouble obtaining car insurance, Acceptance might be another company to add to your list, though the BBB complaints are a bit unsettling, as is the A.M Best strength rating.

Of course, there are pros and cons to all insurers, and when you have to settle for a non-standard policy, choices become more limited.

Maybe most insurers have bad reviews, especially the non-standard ones for high-risk drivers.

While you’re at it, you may also want to address why you’re non-standard to begin with and perhaps attempt to remedy the situation so you can access all carriers and save some dough on your policy and related products going forward.

Streamlining Experience With Acceptance Insurance Claims Process

Ease of Filing a Claim

Acceptance Auto Insurance offers multiple convenient options for filing insurance claims. Customers can choose to file claims online through their website, over the phone by contacting their customer service, or by using their mobile app. This flexibility allows policyholders to select the method that suits them best, making the claims process more accessible and user-friendly.

Average Claim Processing Time

One crucial aspect of any insurance provider is the speed at which they process claims. While specific processing times may vary depending on the nature and complexity of the claim, Acceptance Auto Insurance aims to handle insurance claims quickly and efficiently.

It is essential to note that actual processing times may vary, and customers should contact the company for specific information regarding their claim.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback is a valuable resource for assessing an insurance company’s performance in handling claims. Acceptance Auto Insurance should be evaluated based on customer experiences with claim resolutions and payouts.

Prospective policyholders can read reviews and seek recommendations from existing customers to gain insights into the company’s reputation for fair and prompt claim settlements.

Unveiling Digital and Technological Innovations of Acceptance Auto Insurance

Mobile App Features and Functionality

Acceptance Auto Insurance offers a mobile app that provides policyholders with convenient access to their insurance information and services. The app may include features such as the ability to view policy details, make premium payments, and report claims directly from a mobile device.

Evaluating the functionality and user-friendliness of the mobile app can be crucial for customers who prefer digital convenience.

Online Account Management Capabilities

In addition to the mobile app, Acceptance Auto Insurance offers online account management capabilities through their website. Policyholders can log in to their accounts, review policy documents, update personal information, and perform various administrative tasks.

Assessing the online account management features can help customers determine how easy it is to manage their policies and make necessary changes.

Digital Tools and Resources

Digital tools and resources provided by Acceptance car insurance can enhance the overall customer experience. These may include online calculators, educational resources, and helpful guides related to auto insurance.

Exploring the digital tools and resources offered by the company can help policyholders make informed decisions about their coverage and better understand their insurance options.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.